Nice 1999

- Business Profits Without a Permanent EstablishmentGuglielmo Maisto

In a current case, the Italian tax authorities are claiming that a subsidiary is a permanent establishment (“PE”) of its parent. The provisions of the present Article 5 of the OECD model have changed since the 1963 model: a combination of ancillary activities does not now necessarily constitute a PE (most scholars take the view that this is to be a clarification of the 1963 wording).

If tax in the resident country is higher than that in the source country, then if the resident country applies the credit system, it will not be important whether a PE exists or not. On the other hand, a PE in Switzerland affords a Netherlands company an exemption in the Netherlands.A foreign company may be active in another country and have various levels of presence – having a silent partnership or a venture capital investment or having an active business presence through contract manufacturing or commission agent distributorship.

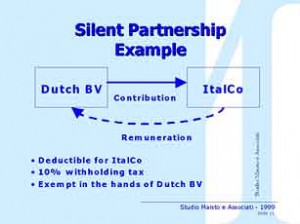

The “silent partnership” is found in civil law countries. The silent partner contributes capital and is entitled to a share of profits: this may be regarded as a dividend (or exempt foreign permanent establishment) in the hands of the recipient and may benefit from a participation exemption but may nevertheless be deductible in computing the profits of the partnership – e.g. where a Dutch BV is a silent partner in an Italian enterprise.

A foreign venture capitalist may take a part of his profit in the form of an advisory fee, paid by a separate company engaged in research, information-gathering, administration etc.

Where a foreign company engages in manufacturing and distribution in the source country, most of the profits will arise in the source country. By transferring the business risk to the foreign company – leaving the local subsidiary to manufacture for the foreign principal and allowing the foreign principal to do its own distribution, much of the profit will be transferred to the foreign principal and the foreign principal may avoid a capital PE in the source country. The clue to success in this kind of arrangement lies in close attention to detail.

Similarly, a distribution company may be replaced by a commission agent – i.e. an agent for an undisclosed foreign principal. Changing an existing situation can give rise to problems relating to the transfer of the goodwill of the distributor.

- Collection & Exchange of Information: Revenue Powers & How They Operate in Aid of Civil Tax CollectionStephen Gray

The basic rule that the courts of one jurisdiction will not enforce the tax liabilities of another jurisdiction is essentially intact – though with some exceptions. Exchange of information is provided in treaties: there are regular exchanges – which include industry-wide simultaneous exchanges; there are spontaneous exchanges – giving information not requested by the recipient; and there are specific requests, regarding the affairs of particular taxpayers. The model US treaty requires that contracting states obtain information and eliminate bearer shares. Generally, the US Government is at liberty to make the information available to other governments. Tax information exchange appears in many treaties – not just those with “tax” in their title.

The proposed EU Directive provides for enforcement of EU member tax claims in other EU countries: whether and when it will come into force is not yet known, but the speaker regarded it as inevitable.The first MLAT was made with Switzerland. Their range has since been extended – to the BVI, Turks and Caicos and elsewhere. They have not yet been extended to tax matters, but this seems likely. The defences in the treaty cannot be raised by an individual, but only by a government. Once the IRS has got criminal proceedings underway (which is not difficult), a US citizen can be compelled to testify, as can a visitor to the United States. By treaty and otherwise, the United States is extending its powers to gather information.

- Indirect Taxes & E-CommerceRolf Koning and Otto Marres

E-commerce is trading over the Internet. The Internet can be used to make payments or simply for advertising, but it is also used for accepting orders and concluding contracts, and for the supply of digital products, e.g. music. The principal tax issues are (i) VAT – the place of taxation and the collection of tax, (ii) income tax – the question of taxable presence and the problem of profit allocation and (iii) withholding tax – e.g. on royalties.

VAT is levied on supply. Where goods are supplied the tax arises where the customer receives them. Where services are supplied (a) to private persons, the tax generally arises in the country of the supplier and (b) to “entrepreneurs”, the tax arises in the customer’s country.The Internet supplier need have no physical presence in the country of the customer, and may change a supply of goods (e.g. CD) to a supply of services (e.g. music). In such a case, VAT may not be chargeable and financial institutions may avoid non-deductible inputs. For example, a supplier in the Netherlands Antilles supplies music, instead of a CD, to a private customer in the Netherlands. The same applies to a supply of software instead of a CD-Rom, or partly one and partly the other – e.g. by way of a sale of a password over the Internet, which the purchaser of the CD-Rom can use. This example has many possible applications.

Corporate income tax arises from some kind of presence – incorporation, effective management, permanent establishment. E-commerce can be conducted without a physical presence. The speaker considered that a server is not a permanent establishment. Problems of transfer pricing, exit charges – e.g. on transfer of customer base etc can arise: there has been little practical experience so far and it is difficult to give clients the guidance they need.

The main area of VAT saving is in the supply of digital services by non-EU suppliers to EU individuals.

- New Problems; New SolutionsRoy Saunders

The problems change little. We are always concerned with fraud and other irregularities, with ensuring the required “management and control”, with the desirability of “substance” (and the distinction between active and passive companies), the need or avoidance of a permanent establishment, the concept of “sham” and the importance of substance in relation to form, the commercial viability of transactions, deductibility of expenses – especially in relation to payments to low-tax jurisdictions, the durability of low-tax regimes (especially in the light of the OECD initiative), the impact of penalties, the enforceability of tax debts, the possibility of double taxation, the existence of tax holidays and incentives, the impact of indirect taxes and the utilisation of the benefit of tax saved.

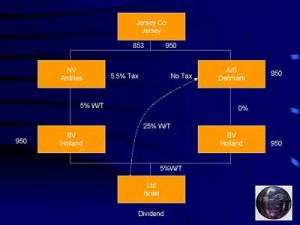

A New Solution of recent introduction is the Danish Holding Company. The new rules came into force on 1st January 1999. If the Danish company has owned at least 25% of non-financial subsidiaries for at least one year, dividends are tax-free, even if the subsidiary itself pays little or no tax. More importantly, there is no tax on outgoing dividends under similar conditions. By contrast, the attribution rules on “financial” companies have been much strengthened. These are companies with a specified proportion of financial assets and paying a low rate of tax.For exemption from tax and capital gains, a 3-year holding period is required. Advance clearance is available, but slow. Consolidated accounts are required. Denmark now presents itself as an alternative to the Antilles as a location for a holding company of an intermediary Dutch holding company.

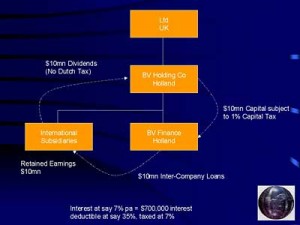

The Dutch finance company is not new but is only recently becoming well-known. It conducts lending and leasing within a multinational group. The regime offers immediate tax deferral and an eventual lower rate (amounting altogether to 15%).

17-18 June 1999

Prepared by Milton Grundy © International Tax Planning Association, 1999

Chairman: Milton Grundy

Indirect Taxes & E-Commerce – Rolf Koning and Otto Marres

The European Court of Justice – Julian Ghosh

The Mareva Injunction – Philip Baker

UK Property – Investment by Non-Residents after the Finance Act 1998 – Michael Flesch

Business Profits Without a Permanent Establishment – Guglielmo Maisto

Transfer Pricing: The Practical Issues – Peter Nias

New Problems; New Solutions – Roy Saunders

Use of Insurance in International Tax Planning – John Hemingway

Collection & Exchange of Information: Revenue Powers & How They Operate in Aid of Civil Tax Collection – Stephen Gray

Indirect Taxes & E-Commerce – Rolf Koning and Otto Marres

E-commerce is trading over the Internet. The Internet can be used to make payments or simply for advertising, but it is also used for accepting orders and concluding contracts, and for the supply of digital products, e.g. music. The principal tax issues are (i) VAT – the place of taxation and the collection of tax, (ii) income tax – the question of taxable presence and the problem of profit allocation and (iii) withholding tax – e.g. on royalties.

VAT is levied on supply. Where goods are supplied the tax arises where the customer receives them. Where services are supplied (a) to private persons, the tax generally arises in the country of the supplier and (b) to “entrepreneurs”, the tax arises in the customer’s country.The Internet supplier need have no physical presence in the country of the customer, and may change a supply of goods (e.g. CD) to a supply of services (e.g. music). In such a case, VAT may not be chargeable and financial institutions may avoid non-deductible inputs. For example, a supplier in the Netherlands Antilles supplies music, instead of a CD, to a private customer in the Netherlands. The same applies to a supply of software instead of a CD-Rom, or partly one and partly the other – e.g. by way of a sale of a password over the Internet, which the purchaser of the CD-Rom can use. This example has many possible applications.

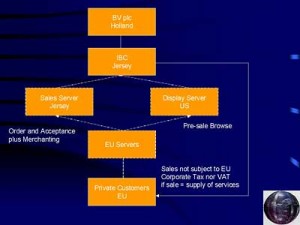

Corporate income tax arises from some kind of presence – incorporation, effective management, permanent establishment. E-commerce can be conducted without a physical presence. The speaker considered that a server is not a permanent establishment. Problems of transfer pricing, exit charges – e.g. on transfer of customer base etc can arise: there has been little practical experience so far and it is difficult to give clients the guidance they need.

The main area of VAT saving is in the supply of digital services by non-EU suppliers to EU individuals.

[TOP]

The European Court of Justice – Julian Ghosh

The Court is re-writing domestic tax laws of member states. The objective is to achieve a common market. A judge is required to be “independent”: he is not there to represent his member state. Many are academics: they read learned articles and often use a judgement to correct what is seen as an error in an earlier one.

Article 6 of the E.C.Treaty enshrines the principle of non-discrimination: people in the same circumstances are entitled to be treated in the same way. This gives rise to fundamental freedoms – e.g. the right of establishment, which override domestic law and are expressed in specific articles. The Court uses European principles of construction: rules (e.g. anti-avoidance) must go no further than needed to achieve its purpose. This derives from the concept of “anti-abuse”. Further developments in this area are foreseen. The doctrine of fundamental freedoms has been applied to tax credit (avoir fiscal), tax repayment, group provisions, credits, deductions, rates of tax, administrative provisions and tax treaties.In St. Gobain, a German branch of a French company wants the benefits of the German treaties. The Advocate General agrees.

The Court does not regard itself as having power to correct internal discrimination or to interfere with the “cohesion” of a tax system. It will support freedom of movement of capital: some of the cases say that it does not give rise to a cause of action and can only be used as a defence; other cases treat it as a fundamental right.

The remedies afforded by the Court extend to damages.

[TOP]

The Mareva Injunction – Philip Baker

A Mareva injunction orders a defendant not to remove, deal with or dispose of his assets. It is designed to prevent a defendant from frustrating a subsequent judgement. It is often obtained ex parte (without notice). The case which gave the remedy its name was decided by the Court of Appeal in London in 1975. It was extended to resident defendants in 1981. It has been extended to a “free-standing” Mareva – i.e. not related to litigation in England. The House of Lords refused such a remedy in the Siskina case of 1972; it has since been established by statute (1982) and a subsequent order (1997). It now extends to world-wide assets – so long as the English Court has jurisdiction over the defendant: such an order was made in the Duvalier case in 1990.

The Woolf reform has included the rules about freezing orders in Part 25 of the Civil Procedure Rules see Part 25.1 (f). Standard forms for domestic and international Freezing Orders are included in the related Practice Direction. The consequence of failure to comply is to be in contempt of court and the penalties include imprisonment. Paragraph 3 of the form provides for exceptions – e.g. for living expenses. The plaintiff must give a cross-undertaking in damages. The defendant can also be ordered to give information or surrender his passport.A Mareva can in principle be granted by a court in any common law jurisdiction and has been granted in many. The free-standing Mareva is not available everywhere: Bermuda followed the Siskina decision, but Jersey did not (in Solvalub); the BVI did (in Kosh v. Chew) but the Isle of Man did not (in SIB v. Braff) nor did the Bahamas (in Groupo Torras).

A Mareva order can be made against a third party. It does not take away the property rights of the defendant, nor does it affect the property rights of third parties. However, a third party to whom an asset has been transferred to defeat the creditor of the transferor can be ordered to freeze the asset. A Mareva also can affect third parties indirectly: a third party who aids and abets a defendant to disobey the order will himself be in contempt. This can apply to a bank, and it will apply to the bank even if the defendant does not at that stage know about the order. A third party can apply to the Court for a variation or clarification of the order. In United Mizrahi Bank v. Doherty, the judge said that lawyers of the plaintiff are not necessarily outside the scope of the order.

[TOP]

UK Property – Investment by Non-Residents after the Finance Act 1998 – Michael Flesch

A non-UK resident investing in UK property will be concerned not to expose himself to inheritance tax or capital gains tax and will want to limit his exposure to UK income tax. The inheritance tax and capital gains tax problem is generally solved by the use of a non-resident company: the company must be clearly non-resident and an investor and not a dealer (unless it has the protection of a tax treaty).

The company will in principle be liable to income tax on the rents. Before 1994, interest was deductible against the rent if it was payable to a bank carrying on business in the UK – even if the investor did not need the money and the borrowing was made “back to back” against a deposit made by the shareholder or other associate of the investing company – e.g. in an offshore branch of the lending bank. (The use of the deposit by an associate had the purpose of avoiding s. 787). This structure had a cost – that of the turn of bank.In 1994 and 1995, the rules were changed in the non-resident’s favour, and now the interest is deductible even if the lending bank carries on no UK business. The test nowadays is simply the “wholly and exclusively” test applicable to all trading expenses: interest at a reasonable rate payable to a non-resident lender now qualifies. No tax is required to be deducted on payment of interest by a non-resident to another non-resident, although if UK property is mortgaged, there is an argument that the interest has a UK source and suffers withholding tax accordingly. The relief for interest no longer depends on the lender being a bank, and after these changes investors re-arranged their borrowing so as to eliminate the bank.

The new rules introduced by the Finance Act 1998 now need to be taken into account. The rules are new and complicated, but their general effect is to empower the UK Revenue to limit relief to such of the interest as would have been paid if the parties had dealt at arms’ length. They look not only at the rate of interest but at the transaction as a whole and an excessive amount of loan may be disregarded. It remains to be seen how tough a line the Revenue are going to take; it seems to the speaker that a pre-1994 type of arrangement falls outside the new rules, because the loan is made by an independent third party, but this is certainly not going to be the Revenue view. The bank may even be a non-UK bank, but here again it may be wise not to use an offshore bank if the bank requires the property to be mortgaged to secure the loan. On re-financing the existing loan, the effect of s.787 needs to be taken into account.

A non-domiciled UK-resident individual commonly owns his UK home through an offshore company. The Revenue appear to have given up their attempt to tax the individual on the rent-free occupation as remuneration of his “directorship” of the company. Some advisers have feared that the new transfer pricing rules may give the Revenue grounds to re-launch their attack, but the Revenue have announced that they are not going to do so.

[TOP]

Business Profits Without a Permanent Establishment – Guglielmo Maisto

In a current case, the Italian tax authorities are claiming that a subsidiary is a permanent establishment (“PE”) of its parent. The provisions of the present Article 5 of the OECD model have changed since the 1963 model: a combination of ancillary activities does not now necessarily constitute a PE (most scholars take the view that this is to be a clarification of the 1963 wording).

If tax in the resident country is higher than that in the source country, then if the resident country applies the credit system, it will not be important whether a PE exists or not. On the other hand, a PE in Switzerland affords a Netherlands company an exemption in the Netherlands.A foreign company may be active in another country and have various levels of presence – having a silent partnership or a venture capital investment or having an active business presence through contract manufacturing or commission agent distributorship.

The “silent partnership” is found in civil law countries. The silent partner contributes capital and is entitled to a share of profits: this may be regarded as a dividend (or exempt foreign permanent establishment) in the hands of the recipient and may benefit from a participation exemption but may nevertheless be deductible in computing the profits of the partnership – e.g. where a Dutch BV is a silent partner in an Italian enterprise.

A foreign venture capitalist may take a part of his profit in the form of an advisory fee, paid by a separate company engaged in research, information-gathering, administration etc.

Where a foreign company engages in manufacturing and distribution in the source country, most of the profits will arise in the source country. By transferring the business risk to the foreign company – leaving the local subsidiary to manufacture for the foreign principal and allowing the foreign principal to do its own distribution, much of the profit will be transferred to the foreign principal and the foreign principal may avoid a capital PE in the source country. The clue to success in this kind of arrangement lies in close attention to detail.Similarly, a distribution company may be replaced by a commission agent – i.e. an agent for an undisclosed foreign principal. Changing an existing situation can give rise to problems relating to the transfer of the goodwill of the distributor.

[TOP]

Transfer Pricing: The Practical Issues – Peter Nias

New legislation in the United Kingdom takes effect for accounting periods ending on or after 1st July. It incorporates the arm’s length test, but a direction is no longer required. The provisions are to be found in Sch. 28AA of the Taxes Act 1988. One is to look at the overall situation as between parties to the transaction: the wording is intended to go wider than a consideration of the acts of the parties to the contract. It is difficult to know how wide are the matters to be taken into account. The question turns on the meaning of the word “provision” in the legislation. The “affected persons” include a wide range of people related to each other in various ways. Much remains to be clarified, but the schedule provides that it is to be construed in such manner as best seems consistent with the OECD model and guidelines.

On the documentation required, the Inland Revenue have issued guidelines – initially highly prescriptive, but subsequently modified. It is plain that penalties will be incurred by fraudulent or negligent conduct, but much of the detail remains to be clarified. Provision is made for approval of advance pricing agreements in complex cases where there are no reliable market comparables. The first stage is an expression of interest, which can be anonymous, but the ultimate agreement may last for 3-5 years.The application of the new provisions are to be monitored by the International Division and further Guidance Notes are expected. Meanwhile, taxpayers must, as best they can, identify affected transactions, test their compliance, adjust affected transactions, and produce and retain documents. Taxpayers may need to de-construct the supply chain, taking a closer look at where the overall profits truly arise and considering the possibility of re-organising profit sources, placing the various functions and the profits attributed to them in jurisdictions having lower tax regimes. Where intellectual property requires to be re-located, it may be “bled” over a period, rather than simply transferred. Industries whose products can be delivered over the Internet in digitised form will be able to dispense with local affiliates in future.

[TOP]

New Problems; New Solutions – Roy Saunders

The problems change little. We are always concerned with fraud and other irregularities, with ensuring the required “management and control”, with the desirability of “substance” (and the distinction between active and passive companies), the need or avoidance of a permanent establishment, the concept of “sham” and the importance of substance in relation to form, the commercial viability of transactions, deductibility of expenses – especially in relation to payments to low-tax jurisdictions, the durability of low-tax regimes (especially in the light of the OECD initiative), the impact of penalties, the enforceability of tax debts, the possibility of double taxation, the existence of tax holidays and incentives, the impact of indirect taxes and the utilisation of the benefit of tax saved.

A New Solution of recent introduction is the Danish Holding Company. The new rules came into force on 1st January 1999. If the Danish company has owned at least 25% of non-financial subsidiaries for at least one year, dividends are tax-free, even if the subsidiary itself pays little or no tax. More importantly, there is no tax on outgoing dividends under similar conditions. By contrast, the attribution rules on “financial” companies have been much strengthened. These are companies with a specified proportion of financial assets and paying a low rate of tax.For exemption from tax and capital gains, a 3-year holding period is required. Advance clearance is available, but slow. Consolidated accounts are required. Denmark now presents itself as an alternative to the Antilles as a location for a holding company of an intermediary Dutch holding company.

The Dutch finance company is not new but is only recently becoming well-known. It conducts lending and leasing within a multinational group. The regime offers immediate tax deferral and an eventual lower rate (amounting altogether to 15%).

The old rules of offer and acceptance apply to E-commerce. It is therefore not difficult to ensure that the contracts are made in a low-tax area. And where the supply is one of service, a VAT saving can also be made. Where a website exists on a US server, US tax issues arise. Here, it is desirable to limit the function of the website merely to a display function, which can be considered as the solicitation of orders, and have a non-US server accept the orders.

- The European Court of JusticeJulian Ghosh

The Court is re-writing domestic tax laws of member states. The objective is to achieve a common market. A judge is required to be “independent”: he is not there to represent his member state. Many are academics: they read learned articles and often use a judgement to correct what is seen as an error in an earlier one.

Article 6 of the E.C.Treaty enshrines the principle of non-discrimination: people in the same circumstances are entitled to be treated in the same way. This gives rise to fundamental freedoms – e.g. the right of establishment, which override domestic law and are expressed in specific articles. The Court uses European principles of construction: rules (e.g. anti-avoidance) must go no further than needed to achieve its purpose. This derives from the concept of “anti-abuse”. Further developments in this area are foreseen. The doctrine of fundamental freedoms has been applied to tax credit (avoir fiscal), tax repayment, group provisions, credits, deductions, rates of tax, administrative provisions and tax treaties.In St. Gobain, a German branch of a French company wants the benefits of the German treaties. The Advocate General agrees.

The Court does not regard itself as having power to correct internal discrimination or to interfere with the “cohesion” of a tax system. It will support freedom of movement of capital: some of the cases say that it does not give rise to a cause of action and can only be used as a defence; other cases treat it as a fundamental right.

The remedies afforded by the Court extend to damages.

- The Mareva InjunctionPhilip Baker

A Mareva injunction orders a defendant not to remove, deal with or dispose of his assets. It is designed to prevent a defendant from frustrating a subsequent judgement. It is often obtained ex parte (without notice). The case which gave the remedy its name was decided by the Court of Appeal in London in 1975. It was extended to resident defendants in 1981. It has been extended to a “free-standing” Mareva – i.e. not related to litigation in England. The House of Lords refused such a remedy in the Siskina case of 1972; it has since been established by statute (1982) and a subsequent order (1997). It now extends to world-wide assets – so long as the English Court has jurisdiction over the defendant: such an order was made in the Duvalier case in 1990.

The Woolf reform has included the rules about freezing orders in Part 25 of the Civil Procedure Rules see Part 25.1 (f). Standard forms for domestic and international Freezing Orders are included in the related Practice Direction. The consequence of failure to comply is to be in contempt of court and the penalties include imprisonment. Paragraph 3 of the form provides for exceptions – e.g. for living expenses. The plaintiff must give a cross-undertaking in damages. The defendant can also be ordered to give information or surrender his passport.A Mareva can in principle be granted by a court in any common law jurisdiction and has been granted in many. The free-standing Mareva is not available everywhere: Bermuda followed the Siskina decision, but Jersey did not (in Solvalub); the BVI did (in Kosh v. Chew) but the Isle of Man did not (in SIB v. Braff) nor did the Bahamas (in Groupo Torras).

A Mareva order can be made against a third party. It does not take away the property rights of the defendant, nor does it affect the property rights of third parties. However, a third party to whom an asset has been transferred to defeat the creditor of the transferor can be ordered to freeze the asset. A Mareva also can affect third parties indirectly: a third party who aids and abets a defendant to disobey the order will himself be in contempt. This can apply to a bank, and it will apply to the bank even if the defendant does not at that stage know about the order. A third party can apply to the Court for a variation or clarification of the order. In United Mizrahi Bank v. Doherty, the judge said that lawyers of the plaintiff are not necessarily outside the scope of the order.

- Transfer Pricing: The Practical IssuesPeter Nias

New legislation in the United Kingdom takes effect for accounting periods ending on or after 1st July. It incorporates the arm’s length test, but a direction is no longer required. The provisions are to be found in Sch. 28AA of the Taxes Act 1988. One is to look at the overall situation as between parties to the transaction: the wording is intended to go wider than a consideration of the acts of the parties to the contract. It is difficult to know how wide are the matters to be taken into account. The question turns on the meaning of the word “provision” in the legislation. The “affected persons” include a wide range of people related to each other in various ways. Much remains to be clarified, but the schedule provides that it is to be construed in such manner as best seems consistent with the OECD model and guidelines.

On the documentation required, the Inland Revenue have issued guidelines – initially highly prescriptive, but subsequently modified. It is plain that penalties will be incurred by fraudulent or negligent conduct, but much of the detail remains to be clarified. Provision is made for approval of advance pricing agreements in complex cases where there are no reliable market comparables. The first stage is an expression of interest, which can be anonymous, but the ultimate agreement may last for 3-5 years.The application of the new provisions are to be monitored by the International Division and further Guidance Notes are expected. Meanwhile, taxpayers must, as best they can, identify affected transactions, test their compliance, adjust affected transactions, and produce and retain documents. Taxpayers may need to de-construct the supply chain, taking a closer look at where the overall profits truly arise and considering the possibility of re-organising profit sources, placing the various functions and the profits attributed to them in jurisdictions having lower tax regimes. Where intellectual property requires to be re-located, it may be “bled” over a period, rather than simply transferred. Industries whose products can be delivered over the Internet in digitised form will be able to dispense with local affiliates in future.

- UK Property – Investment by Non-Residents after the Finance Act 1998Michael Flesch

A non-UK resident investing in UK property will be concerned not to expose himself to inheritance tax or capital gains tax and will want to limit his exposure to UK income tax. The inheritance tax and capital gains tax problem is generally solved by the use of a non-resident company: the company must be clearly non-resident and an investor and not a dealer (unless it has the protection of a tax treaty).

The company will in principle be liable to income tax on the rents. Before 1994, interest was deductible against the rent if it was payable to a bank carrying on business in the UK – even if the investor did not need the money and the borrowing was made “back to back” against a deposit made by the shareholder or other associate of the investing company – e.g. in an offshore branch of the lending bank. (The use of the deposit by an associate had the purpose of avoiding s. 787). This structure had a cost – that of the turn of bank.In 1994 and 1995, the rules were changed in the non-resident’s favour, and now the interest is deductible even if the lending bank carries on no UK business. The test nowadays is simply the “wholly and exclusively” test applicable to all trading expenses: interest at a reasonable rate payable to a non-resident lender now qualifies. No tax is required to be deducted on payment of interest by a non-resident to another non-resident, although if UK property is mortgaged, there is an argument that the interest has a UK source and suffers withholding tax accordingly. The relief for interest no longer depends on the lender being a bank, and after these changes investors re-arranged their borrowing so as to eliminate the bank.

The new rules introduced by the Finance Act 1998 now need to be taken into account. The rules are new and complicated, but their general effect is to empower the UK Revenue to limit relief to such of the interest as would have been paid if the parties had dealt at arms’ length. They look not only at the rate of interest but at the transaction as a whole and an excessive amount of loan may be disregarded. It remains to be seen how tough a line the Revenue are going to take; it seems to the speaker that a pre-1994 type of arrangement falls outside the new rules, because the loan is made by an independent third party, but this is certainly not going to be the Revenue view. The bank may even be a non-UK bank, but here again it may be wise not to use an offshore bank if the bank requires the property to be mortgaged to secure the loan. On re-financing the existing loan, the effect of s.787 needs to be taken into account.

A non-domiciled UK-resident individual commonly owns his UK home through an offshore company. The Revenue appear to have given up their attempt to tax the individual on the rent-free occupation as remuneration of his “directorship” of the company. Some advisers have feared that the new transfer pricing rules may give the Revenue grounds to re-launch their attack, but the Revenue have announced that they are not going to do so.

- Use of Insurance in International Tax PlanningJohn Hemingway

Variable annuities can be used by US citizens to defer tax and avoid estate taxes. Such policies can be taken out with non-US companies if the policy-holder has – in effect – a net worth of at least US$1 million.

Many countries adopt a lenient approach to the taxation of insurance policies – treating them essentially as a saving medium. The use of mutual insurance in the shipping industry – notably in Bermuda – pioneered the use of tax-favourable insurance. This was followed by the development of “captive” insurance in low-tax and zero-tax locations.The United Kingdom regime for the taxation of life assurance may be regarded as characteristic. The investment industry has been active in promoting the purchase of investments with a degree of tax relief at that time given to premiums. The maturity or surrender of the policy attracts no capital gains tax, but if the policy is not a “qualifying” policy, an income tax liability will arise. Since 1983, however, non-UK policies cannot be a qualifying policy. Proceeds of non-UK policies suffer income tax at the full rate; proceeds of UK policies are taxed at the higher rate only (this rule applying to certain EU policies also). The Willoughby case decided that the resident policy holder could not be taxed on the underlying income of a non-UK policy, and this is still true if the investment is not effectively managed by the policy holder. Non-qualifying policies may have uses in circumventing the UK rules for taxing capital gains of foreign trusts. A policy issued under seal is located in the jurisdiction in which the document is found from time to time – which can be useful for inheritance tax planning.